by Chris Mortenson

ChrisMartenson.com

"Tomorrow’s [economic] expansion was collateral for today’s debt."

~ Colin Campbell

The implications from this report are too important to preserve just for the enrolled members who support this site's mission, people, and goals. We're going to open up most of this report to the general public because we feel it's the right thing to do. For those unfamiliar with my work, the job I do most frequently is a combination of information scout (I connect dots) and analyst (I dig deep).

Okay, let's head deeper into the World Energy Outlook (WEO) 2010 report. Here's my quick summary of the report.

By 2035:

- Between 2008 and 2035, total energy demand grows by 36%, or 1.2% per year; far less than the 2% rate of growth seen over the prior 27 years. (Note: This comes from the "New Policies Scenario," which is the middle scenario of three in the report. We'll discuss this one throughout.)

- Renewables will be contributing very little to the overall energy landscape, just 14% of the total, and this includes hydro.

- 93% of all the demand increase comes from non OECD countries (mainly China and India).

- Oil remains the dominant fuel (although diminishing in total percentage).

- The global economy will grow by an average of 3.2% per annum.

- It's time to cut demand for oil by raising prices (they recommend ending energy subsidies for fossil fuels as the mechanism).

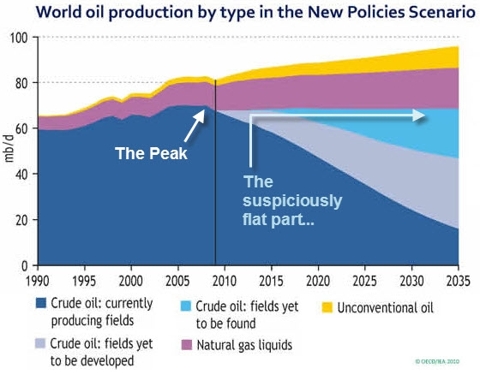

- Conventional oil has peaked, and this is a permanent condition. All oil gains from here forwards will come from non-conventional sources and gas and coal-to-liquids programs.

There are enormous implications to that series of bullet points, if one stops to think about them in total. One glaring difficulty in all of this is that the IEA notes that China and India are going to consume nearly every drop of any potential future increases in oil production. Yet overall production is only going to grow by a meager 0.5% per year.

So how does the IEA suppose that oil growth can slow down to a paltry 0.5%/year, see China and India increase their consumption massively, and still have everything balance out? We all know that China and India (et al.) have been growing their oil consumption by massive percentages in the recent past, and there's some evidence that we can expect more of that behavior in the years to come.

In fact, this was what India's Premier told the world on November 1, 2010:

Premier Manmohan Singh told India's energy firms on Monday to scour the globe for fuel supplies as he warned the country's demand for fossil fuels was set to soar 40 percent over the next decade.

The country of more than 1.1 billion people already imports nearly 80 percent of its crude oil to fuel an economy that is expected to grow 8.5 percent this year and at least nine percent next year.

(Source)

So, yes, it's pretty much expected that China and India, et al., will be increasing their consumption by rates much (much) higher than 0.5%, which means, logically, that some other countries will have to consume at negative rates in order for the equation to balance.

And this is exactly what the IEA has modeled and proposed:

I want to draw your attention to the green circles that I placed on there. Yes, you are reading that right. To balance everything out, the IEA has modeled the OECD as actually decreasing its consumption of coal and oil by significant amounts (that's what a negative 'incremental demand' requires: a decrease in current consumption). The difference is made up from a mix of renewables, biomass, nuclear, and natural gas.

Never has such a thing happened in the entire industrial history of the OECD. Never. There are no models or examples to follow here. No guidance is offered to suggest how such a monumental feat will be accomplished, beyond tossing a few more bucks at renewables, as if money alone could correct for vast differences in energy quantity and quality.

To suggest that the next 25 years for the OECD will be characterized by a significant reduction in the use of the two primary industrial fuels is an astonishing claim, and so it deserves to be carefully examined. But, speaking bluntly, this is not going to happen.

Any suggestion that the OECD is going to reduce its use of coal for electricity and oil for liquid fuels has to be accompanied by evidence of massive programs of investment towards energy transitioning that, truth be told, have to have been started a decade or more before the arrival of Peak Oil. Hinting that it might possibly be a good idea to move these renewable dreams to the drawing board after the advent of Peak Oil is akin to playing tunes on a sinking ship; at best, you are providing a captivating diversion.

Regardless, no such programs operating at appropriate scale are even remotely in sight.

A point that I try to make clear in my upcoming book (due out in March 2011 from Wiley) is that such an energy transition would be evident by such things as the trillions of dollars being dedicated to it, by eminent domain actions to secure new land for natural gas pipelines, and by vehicles that could run on electricity or natural gas being churned out by the millions. While we can debate whether we might get there someday, there can be no doubt that we are not there today.

So if one is a card-carrying member of the mainstream media, what does one do with such a major event as the WEO 2010 report? In the case of the New York Times, the answer is to run a completely schizophrenic pair of articles, but bury the supportive one deep in the "blogs" section while placing the one that completely ignores the WEO 2010 report prominently in the business section.

The first of these two articles, separated by only a day and centering firmly on the IEA report, is titled "Is ‘Peak Oil’ Behind Us?" to which the article correctly answers "Yes":

Is ‘Peak Oil’ Behind Us?

Peak oil is not just here — it’s behind us already

That’s the conclusion of the International Energy Agency, the Paris-based organization that provides energy analysis to 28 industrialized nations. According to a projection in the agency’s latest annual report, released last week, production of conventional crude oil — the black liquid stuff that rigs pump out of the ground — probably topped out for good in 2006, at about 70 million barrels a day. Production from currently producing oil fields will drop sharply in coming decades, the report suggests.

That's pretty accurate. You'd think that such a stunning admission by the preeminent body responsible for preparing such reports for the OECD would have sparked a fury of investigation and maybe even self-investigation by the New York Times, which through the years has pooh-poohed the entire idea of Peak Oil rather religiously. But that didn't happen.

The second article is entitled "There Will Be Fuel" and is chock full of comforting anecdotes and quotes from oil industry executives:

There Will Be Fuel

Just as it seemed that the world was running on fumes, giant oil fields were discovered off the coasts of Brazil and Africa, and Canadian oil sands projects expanded so fast, they now provide North America with more oil than Saudi Arabia. In addition, the United States has increased domestic oil production for the first time in a generation.

“The estimates for how much oil there is in the world continue to increase,” said William M. Colton, Exxon Mobil’s vice president for corporate strategic planning. “There’s enough oil to supply the world’s needs as far as anyone can see.”

Somebody get that man a pair of glasses (!)

Seriously, any country or corporation that cannot foresee the end of cheap and abundant oil is being run by dangerous people. To suggest that even the most optimistic assessment of oil, which has it peaking in 2030, is too far away to begin planning for today is just silly. Really, now...responsible planners considering major capital projects with multi-decade life spans (which can be 30 years or more for many things) should just ignore energy? That's the message here? Goodness, gracious.

In fact, there are so many problems with "There Will Be Fuel" that I hardly know where to turn to next. I suppose we could note that the article quoted "100 years of natural gas" left in the US without mentioning the all-important phrase "at current rates of consumption." To those who are familiar with exponential processes, and who know that energy consumption has been increasing exponentially for decades, such an oversight is an enormous red flag. It betrays either ignorance or deception on somebody's part (perhaps the editor?), and neither are acceptable at this stage of the energy debate. Once we increase consumption at reasonable and prior rates, that 100 years can rapidly shrink to mere decades in a hurry.

What's the difference between "100 years of gas" and "maybe a couple of decades"? Night and day.

Next, we might note that the article goes out of its way to make the case that "estimates for how much oil there is in the world continue to increase," while somehow avoiding the essential point that it's not the amounts that matter, but the rates at which the oil can be coaxed to flow out of the ground. Peak Oil is, has been, and always will be about flow rates, not amounts.

For example, if the very center of the earth were entirely filled with oil, but we could only get to it through a single, very thin tube (limiting how fast we could pull the oil out), it wouldn't really matter how much was there - a hundred trillion barrels could be there - because how much we could do with it would be limited by the rate of extraction. Exponential economic growth requires increases in fuel consumption. It always has and it always will, until and unless a brand new model of economics is developed.

Again, the lack of awareness of this basic concept of the difference between rates and amounts leaves the New York Times piece very much in doubt.

I could go on, but it's not all that helpful to once again catch the New York Times playing fast and loose with the facts in order to advance an agenda; for now, let's just observe that Peak Oil refers to a condition where the rate of extraction cannot be increased. If it were about amounts, then I suppose we would call it "Peak Reserves," but it's not, and for a reason: We care about the flow rates.

It is on this matter of flow rates that the IEA report was especially jarring and succinct: Peak Oil has happened.

At this point, it may be good to remind ourselves that last year an IEA whistleblower said that the organization had willfully underplayed looming shortages due to political pressures from the US.

Please read the following very carefully; it represents very important context for what we are about to discuss next. (I'm quoting at length because it's all essential):

The world is much closer to running out of oil than official estimates admit, according to a whistleblower at the International Energy Agency who claims it has been deliberately underplaying a looming shortage for fear of triggering panic buying.

The senior official claims the US has played an influential role in encouraging the watchdog to underplay the rate of decline from existing oil fields while overplaying the chances of finding new reserves.

The allegations raise serious questions about the accuracy of the organisation's latest World Energy Outlook on oil demand and supply to be published tomorrow – which is used by the British and many other governments to help guide their wider energy and climate change policies.

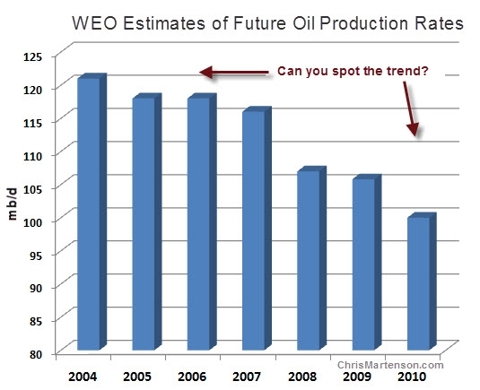

Now the "peak oil" theory is gaining support at the heart of the global energy establishment. "The IEA in 2005 was predicting oil supplies could rise as high as 120m barrels a day by 2030 although it was forced to reduce this gradually to 116m and then 105m last year," said the IEA source, who was unwilling to be identified for fear of reprisals inside the industry. "The 120m figure always was nonsense but even today's number is much higher than can be justified and the IEA knows this.

"Many inside the organisation believe that maintaining oil supplies at even 90m to 95m barrels a day would be impossible but there are fears that panic could spread on the financial markets if the figures were brought down further. And the Americans fear the end of oil supremacy because it would threaten their power over access to oil resources," he added.

A second senior IEA source, who has now left but was also unwilling to give his name, said a key rule at the organisation was that it was "imperative not to anger the Americans" but the fact was that there was not as much oil in the world as had been admitted. "We have [already] entered the 'peak oil' zone. I think that the situation is really bad," he added.

(Source)

The idea expressed above is simple enough: The oil data has been fudged to the upside by the IEA. Pressure has allegedly been applied upon the IEA to paint a rosier picture than a strict interpretation of the data would warrant. To speculate, the reason why is that there are a host of interlocking vested interests in the financial but especially political spheres that would find the public recognition of Peak Oil to be disruptive and therefore unwelcome.

This is just another example of Fuzzy Numbers, but the consequences of fibbing to ourselves about oil are far more dire than when we lie about employment. If it weren't so serious, it would be just another somewhat regrettable obfuscation of reality created to serve narrow and temporal political purposes.

Note: There is a well-recorded history, going back at least 13 years, of the IEA being fully aware of Peak Oil but bowing to political pressure to soften the message. Read paragraphs 4 & 5 of this piece by Colin Campbell for some more essential background.

Conclusion

Here's where we are:

- The IEA has known about looming Peak Oil issues for more than a decade and is only now explicitly recognizing the idea in their public documents.

- People inside and outside of the IEA say that the organization has downplayed both the timing and potential severity of Peak Oil.

- Peak Conventional Oil has already happened.

- Any possible growth in future oil that the IEA can envision -- and we might suspect that even this is fudged to the upside and will retreat in subsequent reports -- is going to be almost entirely eaten up by China and India.

What this means is very, very simple. There will be an energy crisis in the near future that will make anything we've experienced so far seem like a pleasant memory.

The very best personal investments you can make at this stage will involve increasing your energy resilience. Make your house require less heating and cooling, use the sun wherever and whenever possible, and increase your personal storage of the fuels you use (if and when possible).

The potential knock-on effects of less energy to the complex system known as our economy are unpredictable in their exact details and timing, but are thoroughly knowable via their broad, topographical outlines. The economy will become simpler and less ordered.

http://seekingalpha.com